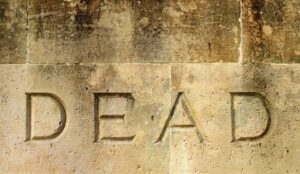

Irish PPO’s: A ‘Dead Letter’

Restitutio in integrum is a Latin term meaning restoration back to original condition or position. It is one of the fundamental guiding principles behind the awarding of damages for negligence cases in common law jurisdictions.

On 1 October 2018, the Civil Liability (Amendment) Act 2017 formally introduced into Ireland for the first time ever a statutory scheme for the payment to catastrophically injured victims a periodical payment order or ‘PPO’. That legislative scheme is now defective, inequitable and described by a High Court judge as a “dead letter” within 3 years of enactment. The recent €23.5m lump sum settlement, the largest in the State’s history, in favour of a 16-year-old who suffered a severe brain injury at birth, is demonstrative of a reluctance for catastrophically injured parties to utilise the statutory PPO scheme that is now defunct.

What is a PPO?

A PPO is an annual payment for the lifetime of a catastrophically injured party instead of a traditional lump sum payment. The PPO provides full cover for certain future costs and avoids the party taking the risks associated with a lump sum payment such as predicting life expectancy and investment returns.

The Legislation

PPO’s are provided for in section 51 of the Civil Liability (Amendment) Act 2017. Interestingly, the legislation departed from the recommendations of a Working Group on Medical Negligence and Periodic Payments made in 2015. Critically, the Working Group recommended that PPO’s should provide for indexation to inflation in carers wages as an “essential prerequisite” to the statutory scheme. Instead, the legislation did the opposite and indexed PPO’s to the Harmonised Index of Consumer Prices (HICP). This departure by the legislature has meant that the future care and medical treatment costs for catastrophically injured victims is inextricably linked to a broad basket of goods and services. The consequence of this decision has been fatal and hopelessly undermines the operation of the scheme.

The Current Pain Points: limited right of appeal, no variability but most of all indexation

The legislation is defective and inequitable on several levels. Firstly, the statutory scheme provides for a limited right of appeal on a point of law only, not the facts. Catastrophic injury cases will invariably be fact specific and are the main driver in the quantum of catastrophic injury cases. For example, does the victim require 24 hour medical care or not? Conversely, under a lump sum award system, a victim is not limited in such a way and has a right of appeal not solely confined in law. There is currently also no provision in the legislation for Irish courts to make a variation order if there is a deterioration in the victim’s condition. However, the biggest flaw unquestionably with the current PPO system is indexation which is completely inferior and not fit for purpose compared to other common law jurisdictions. Economic experts have been critical of the current regime and the Government’s decision to index link payments to the HICP. Professor Wass, labour economist, concluded that minimisation of the volatility of such annual payments was the key motivating factor and that CSO earnings and employment costs would be a more appropriate metric.

Caselaw

In Hegarty (a minor) -v- HSE [2019] IEHC 788, a case involving a minor who suffered catastrophic injuries at birth leading to cerebral palsy, the inadequacies of the PPO regime were laid bare. Ms. Justice Murphy found significant discrepancies in the legislation and held that there was overwhelming evidence that a PPO linked to the HICP would result in under-provision. The unanimous expert evidence agreed that indexation linked to the HICP would not meet the future care needs of catastrophically injured parties. Ms Justice Murphy also went further and stated that:

“In its current form therefore, the legislation is regrettably, a dead letter. It is not in the best interests of a catastrophically injured plaintiff to apply for a PPO under the current legislative scheme”.

She also found that as a matter of probability, by the time the catastrophically injured boy reached the age of 50, a PPO would only meet 48% of his future care costs.

Other Jurisdictions

PPO’s have been available in England and Wales since 2003. In the UK, PPO’s are index linked to the ASHE Index which is an annual earnings survey applicable to carers and care assistants. In this way, the PPO will ensure 100% that there is no risk of shortfall to the future care costs of a catastrophically injured party. Scotland has also recently moved to introduce PPO’s under the Damages (Investment Returns and Periodical Payments)(Scotland) Act 2019. The rules under the Scottish PPO system have yet to be published but it is thought likely that they will follow the England and Wales model. The current Irish legislation is therefore an outlier compared to other common law jurisdictions.

Conclusion

The purpose of a PPO is perfectly valid: to ensure that the future care needs of catastrophically injured parties are funded for the remainder of their lives, thereby removing the uncertainty under a lump sum payment system. However, the current HICP index linked statutory scheme is hopelessly compromised and not fit for purpose. The High Court decision in Hegarty must lead to a reassessment of the statutory PPO scheme on the issues of variability and limited right of appeal. The overwhelming inequity of the current statutory scheme however is indexation. Why should the future care and medical treatment costs of a catastrophically injured party who is peg fed, non verbal, incontinent and requiring 24 hour medical care be linked to consumer prices? It is illogical at best and, at worst, it is a shameful indictment on Government. Why was the HICP index chosen over an index linked to earnings or carers wages? Page 5 of a report from the Department of Finance, which assessed the regulatory impact analysis of the Bill, cites that the HICP index mitigated “the potential negative impact on the insurance industry and on premiums”.

The current statutory scheme clearly contravenes the fundamental principle of restitutio in integrum. What is the solution? Simples. The Minister has the power to carry out a review of the current indexation of PPO’s after 5 years. Giving Irish Courts the power to vary a PPO in the event there is a deterioration in the condition of a catastrophically injured victim would help together with a full right appeal on the facts, not just a point of law. This review should be expedited to ensure Ireland’s statutory scheme comes back from the dead.

If you need more information, please contact Ronan Hynes, Partner at Sellors by email at [email protected]